Give Middle Class Families a Tax Break

WASHINGTON, D.C. –Rep. Dan Newhouse (R-WA) released the following statement on the House Republicans' legislation, The Tax Cut and Jobs Act, to provide historic reform to our nation's tax code:

"For the first time in more than thirty years, we have the historic opportunity for major reform to the tax code to reduce the burden on American families and spur economic growth," said Rep. Newhouse. "Middle class taxpayers need a break, and our bill provides it. Under our plan, a typical middle-income family of four that earns the median household income will receive a $1,182 tax cut. Our plan allows American small businesses and corporations to be more competitive and hire more workers. I am excited to work with my colleagues on this reform to simplify the tax code, help families, and stimulate job creation."

Fast facts on the tax reform legislation unveiled today:

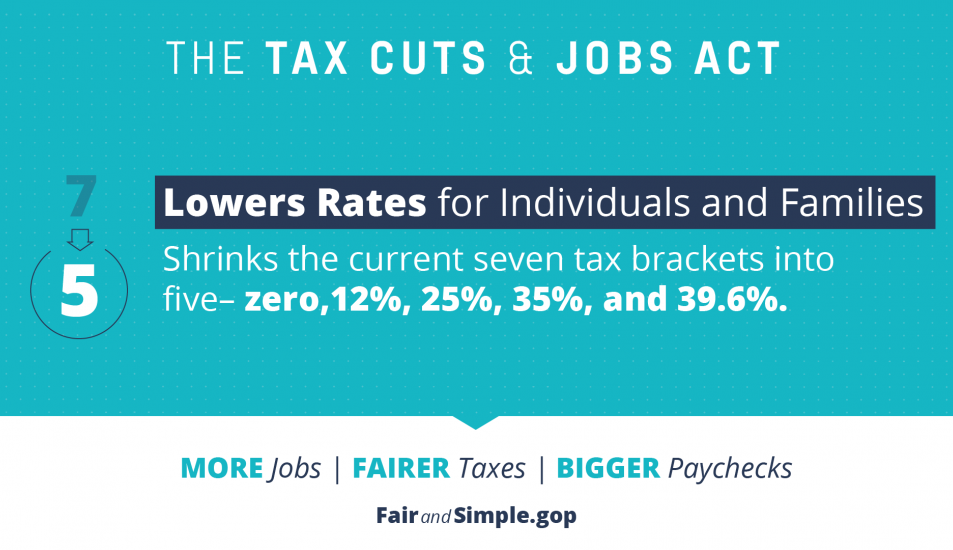

Lowers individual tax rates for low- and middle- income Americans to zero, 12%, 25%, and 35% so people can keep more of the money they earn throughout their lives, and continues to maintain 39.6% for high-income Americans.

Significantly increases the standard deduction to protect roughly double the amount of what Americans earn each year from taxes – from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples.

Expands Child Tax Credit from $1,000 to $1,600 to help parents with the cost of raising children and providing a credit of $300 for each parent and non-child dependent to help all families with their everyday expenses.

Preserves the home mortgage interest deduction for existing mortgages and maintains the home mortgage interest deduction for newly purchased homes up to $500,000 – providing tax relief to current and aspiring homeowners.

Continues to allow people to write off cost of state and local property taxes up to $10,000. According to the Internal Revenue Service data, 80.4% of residents of the 4th Congressional District claim the standard deduction when filing. The average amount of itemized deductions in the 4th Congressional District is $21,075, below the state average of $24,660 and the national average of $27,830. Congressional district data available here.