“Real Tax Relief for Families”

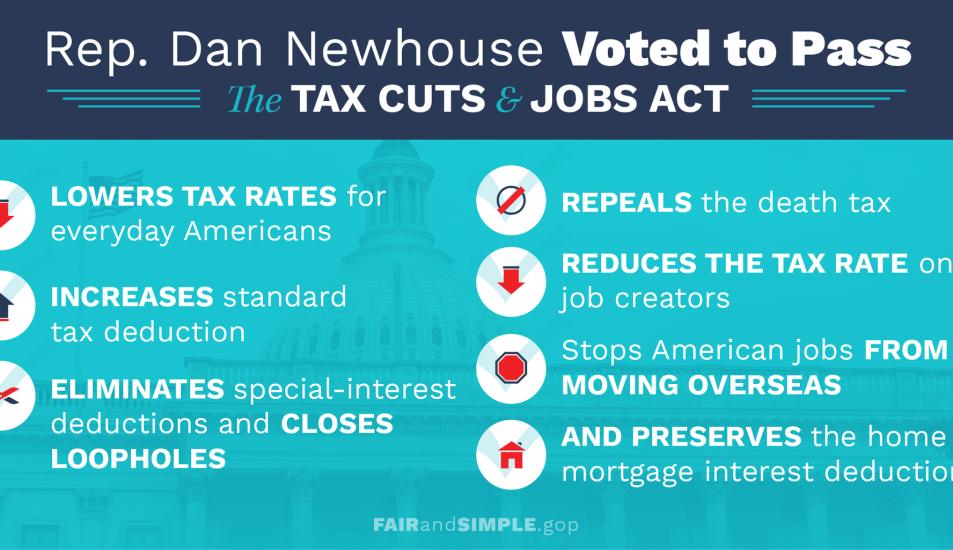

WASHINGTON, D.C. – Rep. Dan Newhouse (R-WA) released the following statement after voting in favor of H.R. 1, The Tax Cut and Jobs Act, to provide historic reform that cuts taxes and simplifies our nation's tax code:

"I was proud to cast my vote today for historic tax reform that provides a simpler and fairer system for families and businesses in Central Washington," said Rep. Newhouse. "This reform flattens rates and lifts burdens from taxpayers, and it unleashes American businesses, large and small, to better compete. About eighty percent of filers in the Fourth District use the standard deduction, so doubling it will provide real tax relief for the majority of families. Reform will boost manufacturers by allowing small businesses and farmers to immediately write off the full cost of new equipment. Reform will repeal the unfair death tax, which hinders family farms and small businesses from passing on the success of a lifetime of hard work on to the next generation. As this process continues, I look forward to working with my colleagues in the Senate to send legislation to President Trump for his signature."

Click here to WATCH Rep. Newhouse Floor Speech in Support of H.R. 1, The Tax Cuts and Jobs Act.

Congressional district tax return data available here.

A recent analysis by the non-partisan Tax Foundation found that the Tax Cuts & Jobs Act will add an estimated 19,968 new full time jobs to Washington State's economy and increase after tax income for middle-income families by $2,672.

Fast facts on H.R. 1:

Lowers individual tax rates for low- and middle- income Americans to zero, 12%, 25%, and 35% so people can keep more of the money they earn throughout their lives, and continues to maintain 39.6% for high-income Americans.

Significantly increases the standard deduction to protect roughly double the amount of what Americans earn each year from taxes – from $6,350 to $12,000 for individuals and $12,700 to $24,000 for married couples.

Expands Child Tax Credit from $1,000 to $1,600 per child to help parents with the cost of raising children and providing a credit of $300 for each parent and non-child dependent to help all families with their everyday expenses.

Preserves the Adoption Tax Credit.

Preserves the home mortgage interest deduction for existing mortgages and maintains the home mortgage interest deduction for newly purchased homes up to $500,000 – providing tax relief to current and aspiring homeowners.

Continues to allow people to write off cost of state and local property taxes up to $10,000. According to the Internal Revenue Service data, in 2014, 80.4% of residents of the 4th Congressional District claimed the standard deduction when filing.